Accounting / Consulting Firms

Extend involvement with your clients

with our senior-level professionals as part of your team.

We Help Create, Protect and Optimize Enterprise Value.™

Consulting / Advisory Support Services

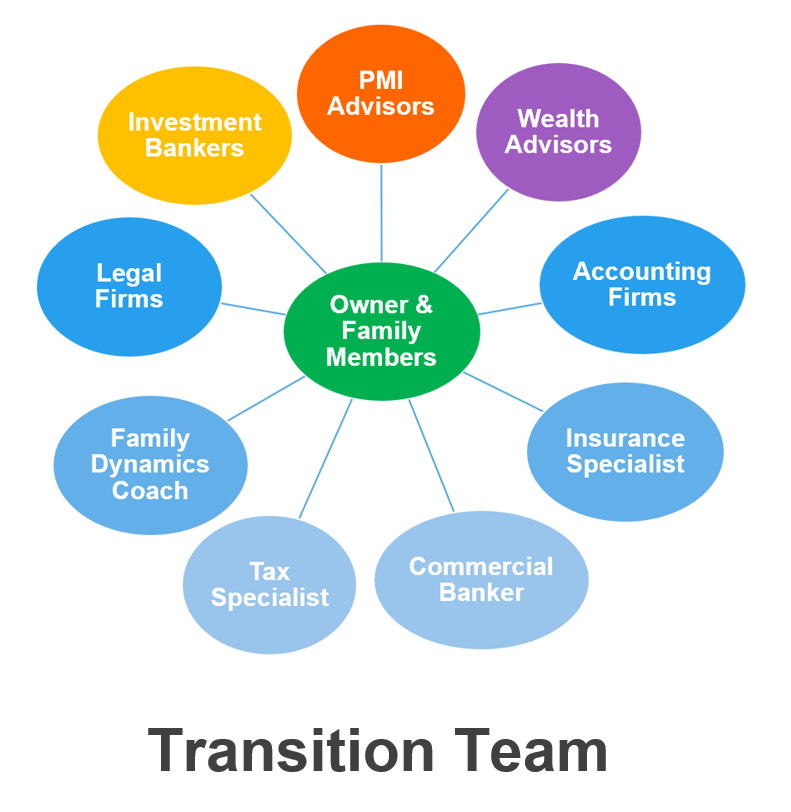

For today’s complex business environments, accounting firms provide a range of consulting and advisory services for their clients in addition to standard audit/tax practices. In offering expanded services for both buyers and sellers in partnership with us, accounting firms are able to extend involvement with their clients.

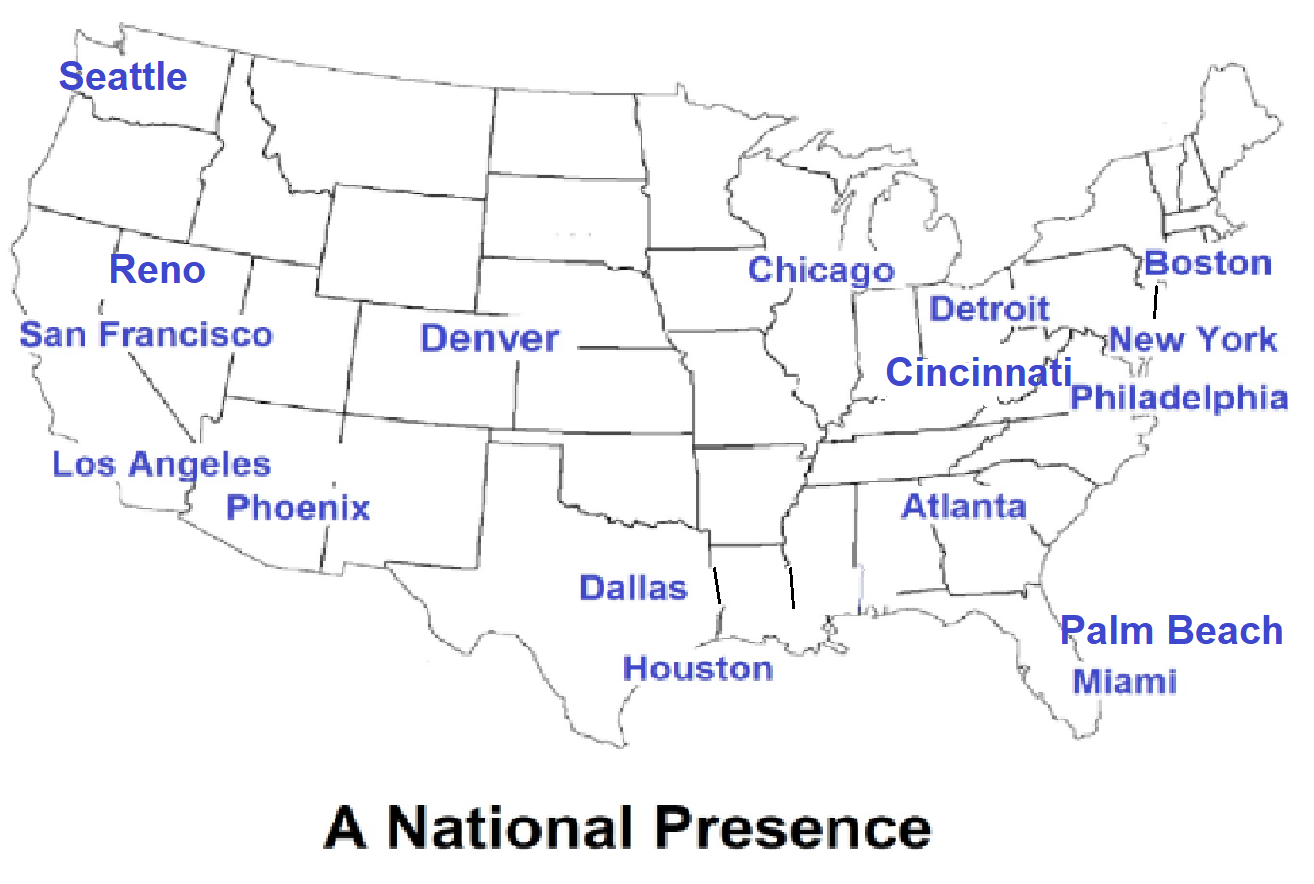

PMI Advisors has entered into Subcontract/Referral Agreements with several national accounting / consulting firms to provide our team of senior-level professionals as interim staffing resources to assist them in serving their existing and potential clients.

Exit Planning - Business Sale Preparation Services

PMI Advisors works with consulting and accounting firms to assist their Business-Owner Clients with Business Sale Preparation. Statistics show that the majority of businesses that go to market don't sell, leaving those Owners without solid options. However, an Owner/CEO who is “ready” with an attractive business greatly increases the odds that the business will find a serious buyer. Recognizing this, we work with Owners/CEOs to approach the exit strategy with the same focus and drive that helped to build their businesses.

Our Deal Readiness® Methodology (Brochure 2-pages) (Presentation 28-pages) gives an Owner/CEO an opportunity to strengthen the overall quality and competency of their company in advance of the sales process. It is a road mapping procedure that utilizes a proprietary assessment and management tool that helps a business maximize its value.

A Mutually Beneficial Relationship

Additionally, we work with consulting and accounting firms by providing interim senior-level staffing resources to extend services offered to the firms’ clients. Our team is pleased to assist, on a no-charge basis, with pre-sales activities for internal preparations and discussions, followed by client proposals and presentations.

There are a variety of contractual methods for delivering consulting services, ranging from a fixed-fee basis for identified scopes of work to daily or hourly consulting rates. We recognize that firms are in the best position to gauge the end-client’s interests and the acceptable market billing rates.

Our goal is to work with accounting and consulting firms to expand the services that they are able to provide for their clients. Benefits of our services include:

- Billable Hours of Internal Resources Increased - With our senior-level team members as project leaders, firms are able to pursue engagements that will utilize their existing internal resources for numerous detailed workstream activities.

- No Additional Senior-Level Practice Staff Required - We are able to quickly provide "seasoned" expertise on-demand, eliminating the need to add additional internal senior-level staff for interim client projects.

- Clients "Drifting" to Competitors Reduced - By extending firms' services with our resources, they maintain client relationships for ongoing audit/tax work and don't lose clients due to a lack of available services.

- Conflict of Interests Eliminated - We are able to contract directly with the firm's clients when conflicts arise, allowing the firm to maintain "connectivity" with those established client relationships.

Optimize Client Enterprise Value

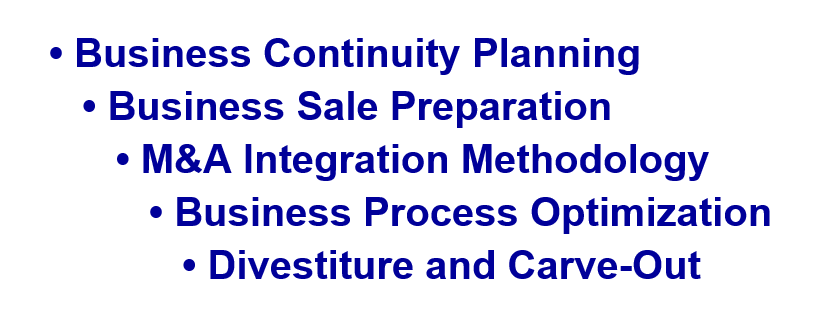

PMI Advisors provides resources and services to support the following range of services:

Typical Engagement Scenarios

Our Team of professionals brings industry and functional expertise that includes:

Below are typical scenarios where our senior-level team members may serve as leaders for M&A projects:

- Merger Integration Leader – PE firm, that is acquiring 2 companies in the professional services industry, is combining them into a newly branded entity.

- Carve-Out Leader – PE firm is acquiring and carving-out a manufactured product division of a Fortune 500 company over a period of 1 year.

- Interim CFO – Portfolio company quickly needs an interim CFO for several months while recruiting and onboarding a permanent CFO.

- Marketing/Sales/Support Segmentation Leader – Growing manufacturing company recognizes that their “one size fits all” approach is not working and needs to segment their customer base for better client results and increased profitability.

- IT and HR Due Diligence Leaders – Company that has been aggressively acquiring private schools for the past 2 years needs analysis of inherited disparate IT and HR systems and development of a cohesive go-forward plan.

- Interim CIO/Cybersecurity Leader – National residential property management company needs interim CIO with cybersecurity focus for rapidly expanding property portfolio.

- ERP Implementation Leader – Established company in the fabric printing industry, positioning itself for sale in 2 years, needs to source and implement an ERP system to replace their “homegrown” version.

- Supply Chain Leader – PE firm evaluating the acquisition of a platform company in the metal fabrication industry needs due diligence assistance evaluating the target's supply chain process since numerous add-ons are anticipated.

Our professionals are former Corporate C-Suite Executives, VPs and Directors with broad and deep experience in a variety of industries. A number of them have also held senior positions with major consulting firms.