Business Continuity

Emergency Operations Planning (EOP)

We Help Create, Protect and Optimize Enterprise Value.™

$1,995.00

Get a straightforward Business Emergency Operations Plan (EOP) within 48-hours, that will give your company the best chance to survive if you, as the Owner/Operator, are suddenly unavailable for weeks or months.

Our professionals facilitate sessions with a detailed 12-page questionnaire for the development of the EOP. Prior to the initial planning session, an NDA will be submitted, since the information to be provided is highly confidential... We take your trust seriously.

Business Emergency Operations Planning (EOP)

Despite everyone’s best efforts and best wishes, sometimes bad things happened to good people. There is nothing that any of us can do about it, except to plan for that possibility. Life insurance comes into the picture in the event of death, but what about incapacity for several weeks or months?

Closely-held private companies may have information technology recovery plans. However, we have found that many fail to develop a Business Emergency Operations Plan (EOP), a set of instructions that can be delivered to the Owner/Operator's family, management team, accountants, attorneys, and other advisors in the event that he/she is suddenly unable to manage the business.

A recent survey of closely-held businesses by a global wealth management firm revealed that more than 80% of those businesses have NOT prepared detailed written instructions for the company operations in the event that a key Owner/Operator is unable to work for several weeks or months due to an illness or accident.

Among Other Directives a Business EOP:

- Provides specific steps for what to do if the Owner/Operator cannot work for a stated period of time.

- Addresses operations and not ownership: A Buy-Sell Agreement addresses ownership issues.

- Identifies who takes over the Owner/Operator's duties resulting from triggering events.

- Outlines who takes over the duties of other employees.

- Makes recommendations for interim compensation adjustments and other considerations.

- Identifies what authority each senior team member has: hiring, firing, check writing (what limit, counter-signing) etc.

- Spells out the duties of those whose positions will change and what happens if the Owner returns to work.

- Identifies key customers, suppliers and vendors that need to be contacted immediately.

- Points out when an outside operator should be considered.

- Presents a plan for what to do if the Owner does not return to the business.

- Outlines considerations of whether the business should be sold to an insider or third party.

Once completed, the basic provisions of the EOP are shared with family members, key people, and professional advisors. The original signed EOP document should be stored in a safe place that is known to a trusted advisor, family member, or key person. However, the safe place is NOT to be in a safe deposit box which may be inaccessible in the event of owner incapacitation when the EOP is urgently needed.

Consider the Following Scenario:

Charles Griffin’s company, Griffin Construction Company, was in the midst of a business boom. As the face of the company, Charles was preparing to open Griffin Construction’s third location. On the day the new location was to open, Charles failed to show up for work. A few hours passed before Paul, Griffin Construction’s VP of Sales, received a call from Charles’ wife, Lisa.

Charles Griffin’s company, Griffin Construction Company, was in the midst of a business boom. As the face of the company, Charles was preparing to open Griffin Construction’s third location. On the day the new location was to open, Charles failed to show up for work. A few hours passed before Paul, Griffin Construction’s VP of Sales, received a call from Charles’ wife, Lisa.

Lisa told Paul that she was with Charles in the hospital. Charles had been involved in a car wreck and had multiple, serious neck and chest injuries, fortunately not life threatening. However, the doctors told her that Charles may be sidelined and not able to talk or work for several weeks… possibly months. She asked Paul to set up a company meeting for 8:00 am the following morning for her to meet with the management team.

“Charles did a very good job of planning.” Lisa told the group. “In fact, he had worked on a plan to protect against something like this.” She explained that Charles left written instructions about who would take over certain responsibilities and the management control cross-checks that would be put in place. Paul would take over as interim President, and Griffin Construction’s Operations Manager, Bruce, would take full control over operations and accounting leadership. Each received a 25% salary bump to reflect their new interim responsibilities.

Over the next few days, Griffin Construction used the instructions that Charles provided. The company’s clients and vendors were assured that Paul and Bruce would provide the same service and timely payment they’d always expected. Over the following three months, the company thrived, even without Charles at the helm.

In short, Charles’s business, family, and employees all continued to move forward despite his accident, all because he had prepared detailed instructions and plans for how the business would survive without him for an extended time.

Frequently Asked Questions (FAQ)

Why doesn’t an Owner/Operator just take the time to write down their plans?

The lack of time and a format for developing an EOP is the best answer. A Business Owner is stretched to the limit, especially in these economic times and will readily admit that an EOP is a good idea… when they can “get around to it.”

Why doesn’t a Business Owner just have their Admin Assistant develop the EOP?

Oftentimes, the EOP will identify certain individuals that may be considered for succession planning or promotion consideration. The internal “leakage” of this information to others in the company, prior to the EOP being actually needed, could present major personnel problems.

How quickly can an EOP be developed?

Knowing that time is of the essence, we can have an EOP developed within 48-hours, after our 1-hour video or phone session to review our Questionnaire with the Business Owner.

While a draft of the EOP is being developed from answers to the questionnaire, it is very important that the Owner/Operator write a brief introductory cover letter that will be included in the EOP. The stakeholders of the company including family members, management, employees and advisors will want to hear the wishes for the company’s future, in the Owner/Operator's own words.

Business Continuity Planning

Business Continuity Planning is the proactive process to make sure that the businesses overcome serious incidents or disasters and resume normal operations within a reasonably short period. Typical incidents that business continuity covers may include fires, floods, accidents caused by key people, server crashes, virus infections, insolvency of key suppliers, and negative media campaigns, to name a few.

Continuity planning is an important tool for risk management because it provides a structured way to identify the sources of business disruption and assess their probability and harm. It is expected that all business functions, operations, supplies, systems, relationships, etc. that are critically important to achieving the organization's operational objectives are analyzed and included in the continuity planning process.

Effective business continuity planning is a process that moves through five major steps. These steps have key planning activities associated with them and are best described as:

- Threat Assessment – The Threat Assessment allows you to understand which man-made or natural disasters could have the most significant impact on your company.

- Identify Critical Functions – The second step involves identifying the critical functions. A Critical Function can be defined as a part of your operation which, if interrupted, would disrupt your company’s ability to deliver its goods and services to your customers. This step will help you identify those functions that are most important and when a specific function needs to be restored before it has an impact on your company and its customers.

- Business Impact Analysis – The Business Impact Analysis combines the Threat Assessment and Critical Functions steps to prioritize your resources and efforts.

- Prevention and Mitigation Planning – This step will help you identify the steps that need to be taken to help prevent damage and to restore business operations.

- Implement and Maintain the Plan – Your plan should be updated no less than annually (and more frequently if facilities or operations change) and drills should be conducted to be sure the plan is working as designed.

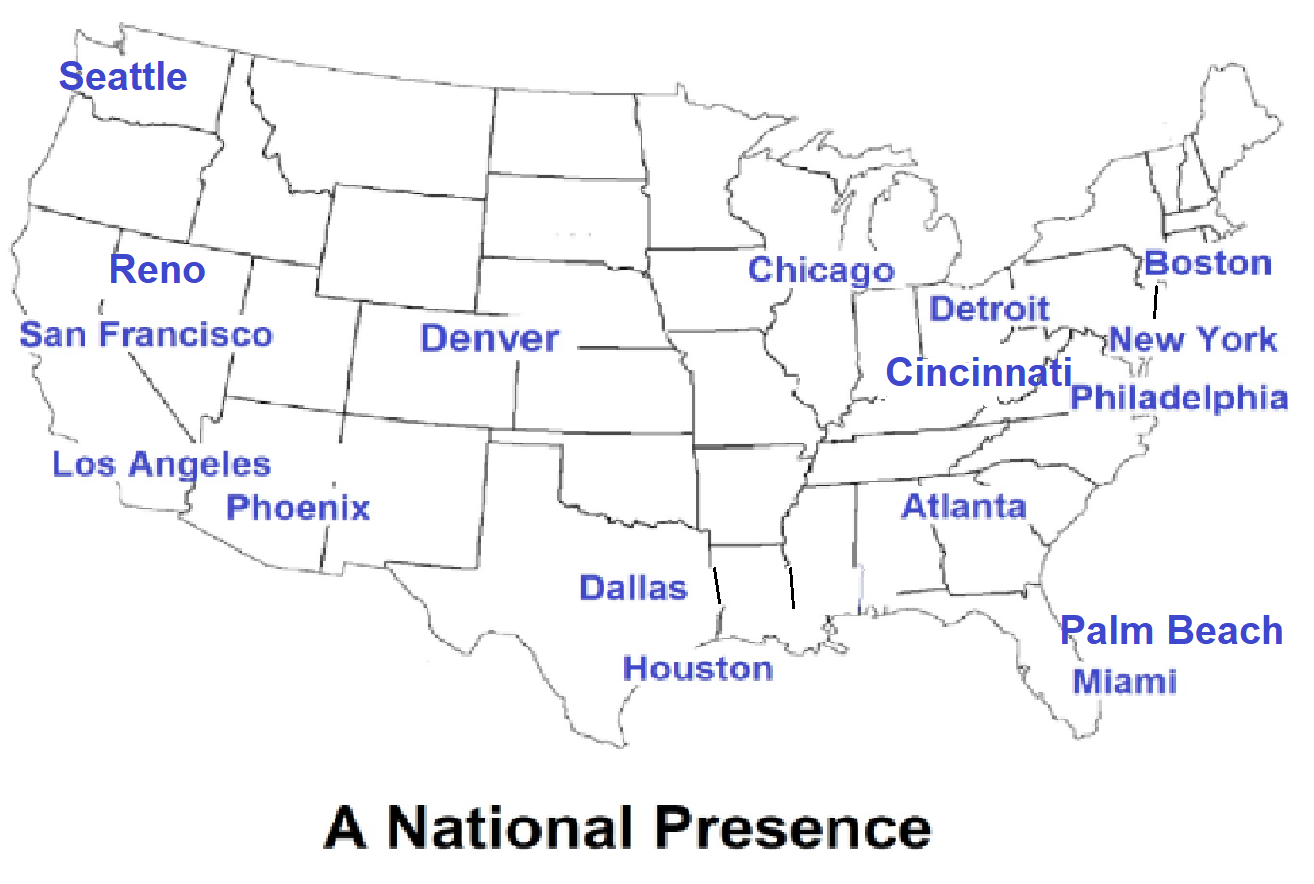

The management of business continuity falls largely within the sphere of risk management, with some cross-over into related fields such as governance, information security, and compliance. Many organizations may have information technology recovery plans, but we have found that many fail to address business process continuity. Our nationwide team of professionals designs and implements high-level Emergency Operations Plans and thorough Business Continuity Plans that address the real impacts on our clients' business operations.