Business Process Optimization

Systematically pursue additional

performance-improvement benefits

We Help Create, Protect and Optimize Enterprise Value.™

Business Process Optimization

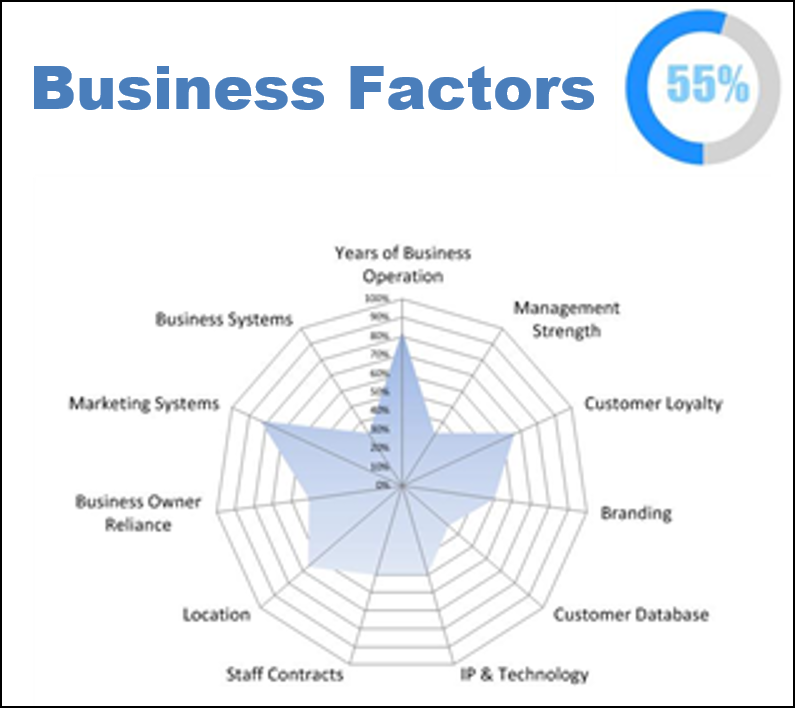

Business Process Optimization is about focusing on the intersection of people, technology, and processes and creating strategies to leverage technology. We utilize over 20 assessment and implementation factors through our Readiness Rating® Methodology to identify strategic and operating gaps throughout a company and its’ entire work process flow.

Our senior-level professionals identify short-medium-long term opportunities and utilize cross-functional workshops to create implementation roadmaps, sometimes associated with M&A activity after the critical merger integration activity has taken place in the first 100 days post-close. We implement these roadmaps alongside client teams using lean business tools such as business process re-engineering, KPI’s, continuous improvement, customized training and process value mapping. Our consultants work with our clients through the entire optimization process.

Optimization Expertise

Optimization excellence goes well beyond cutting costs. It’s about achieving greater flexibility, agility, and higher levels of responsiveness to increase competitive advantage and fuel growth. In a challenging global marketplace, our clients' operations teams are constantly under pressure to operate safely, deliver faster, cut costs, increase capacity, and improve quality.

- Business Process Re-engineering

- Value Stream Mapping

- Supply Chain Optimization

- Corporate Finance

- Employee Alignment and Engagement

- New Product Development

- Continuous Improvement

- Organizational Design and Development

- Business Process Management

- Lean Business Practices

- Business Transformation

- Business-IT Alignment and Services

We don’t just look at the process. We look at its financial performance and strategic relevance as well. We can do an analysis of the financial performance of a function, such as marketing/sales or an entire supply chain.

Leveraging for Rapid, Sustainable Growth

We help our clients improve operational speed to increase agility, flexibility, and responsiveness and lower the cost-to-serve. Depending on the goals, we can deliver immediate short-term performance improvements, or we can implement long-term cultural transformation where operational optimization initiatives are tied directly to the plans for profitable growth. From short-term cost-out and cash flow improvements to broad-reaching performance improvements, we help our clients achieve operational excellence that rapidly translates directly into measurable financial results and rapid, sustainable performance that drives growth. Our professionals have accomplished the following:

- Implemented business process re-engineering in financial services, manufacturing, distribution, marketing/sales, engineering, purchasing, and technology

- Planning and leading financial and operational restructuring

- Moved geographic locations for products and factories

- Developed new process lines in multiple industries

- Rationalized the entire supply chain for multi-national corporations

- Implemented change management and performance management systems in large and small companies

- Lead organizational design and development projects

- Designed and implemented business transformations

- Restructured IT services in many industries

In our Business Process Optimization projects, we focus on the strategic objectives of the company and the metrics that will foster sustainable high performance. We provide our clients with proven strategies, tactics and tools to optimize their business, parts of it or fully transform it.