Human Resources Integration

Assistance before and after deal-closing

with the significant challenges and implications of the

"people issues" created by the transaction.

Consolidating Policies, Technology, and Compensation Plans

In addition to providing our Project:100 Days™ integration methodology, our team and partners are able to assist before and after deal-closing with the significant challenges and implications of the "people issues" created by the transaction. The business case for the involvement of Human Resources (HR) professionals at every step in the M&A process is well established in advising management on human resource matters, including using surveys and other metrics to gather relevant data, identifying potential conflicts between the two companies, integrating HR practices, and managing talent decisions.

Human Resources Due Diligence

Cultural compatibility issues often arise when bringing together two organizations, because culture encompasses the beliefs and assumptions shared by members of an organization. Since cultural differences can affect important M&A outcomes, focusing on cultural alignment has been identified as one of the top challenges. During due diligence, information about talent and culture, along with typical assessments of employee benefits plans and liabilities, compensation programs, employment contracts and policies, legal exposure, and more, can provide insights into the value of a potential acquisition and can decrease the likelihood of expensive surprises once the deal is complete. A thorough review of the potential acquired organization's legal position generally takes place during the due diligence phase of the transactions with all people-related policies, plans, practices and programs scrutinized to ensure compliance with applicable employment laws and regulations.

Retention of Key Employees

Early placement of management is a critical factor in beginning to stabilize the new organization. Any delays in placing key managers may complicate the transition by increasing uncertainty, diverting attention and fostering internal competition. A major challenge for the acquiring company is in deciding who to retain, who to redeploy and who to terminate, as well as effectively managing those processes. To retain key talent that will help make the combined organization successful, management should communicate its intentions to the "key performers" as early in the process as is legally possible. This means requesting access to conduct confidential interviews with key employees in advance of the actual closing date. Most importantly, management should be very careful to pay special attention to these key people, or they will consider other employment options. Star performers know who they are and understand their personal and professional marketability.

Consolidating Policies and Technology

In shaping the culture of the newly combined organization, the acquiring company must develop and communicate to employees a cohesive people-related strategy. Such a strategy should include the development of key policies, rules, and guidelines to govern employee behavior and related workplace expectations. Also, managing Human Resource Information Systems (HRIS) technology and deciding which systems to keep or replace, as well as which functions to outsource, can be a highly complex undertaking. Making such decisions requires that employers thoroughly assess the HRIS systems and people capabilities of both organizations.

Adjust Compensation Plans

Depending on the circumstances of the compensation policies of the combined companies, disparate payment plans may need to be spliced into a program that fits the new organization. Another option may be to discard the original plans and create a program from scratch that meets the goals and direction of the newly merged entities. Additionally, members of the senior management team may be anxious to see what types of special arrangements (e.g., stock options, special retirement provisions, severance agreements) will be offered to them given the high-profile nature of the new positions. The development of an executive compensation strategy will require an additional set of complex decision-making, as well as board approvals.

Communication, Communication, Communication

A well-planned communication strategy is critical in the M&A process. Effective communication involves providing information on the shared vision for the new company, the anticipated benefits, and the rough timelines for future decisions. Communicating clear, consistent and up-to-date information not only will give employees a sense of control by keeping them informed, but it also can increase the coping abilities of employees and minimize the impact of the integration on performance.

Critical to successful integration is the manner in which the restructuring is implemented. The highest priority is that the acquiring company needs to be straightforward about what is happening and what is planned. Even when the news is bad, the one thing employees of newly acquired companies appreciate most is the truth. That includes being able to say "we don't know" about certain areas or "we have not yet decided" about others. Being honest also includes sharing information about when and by what process a decision is expected to be reached.

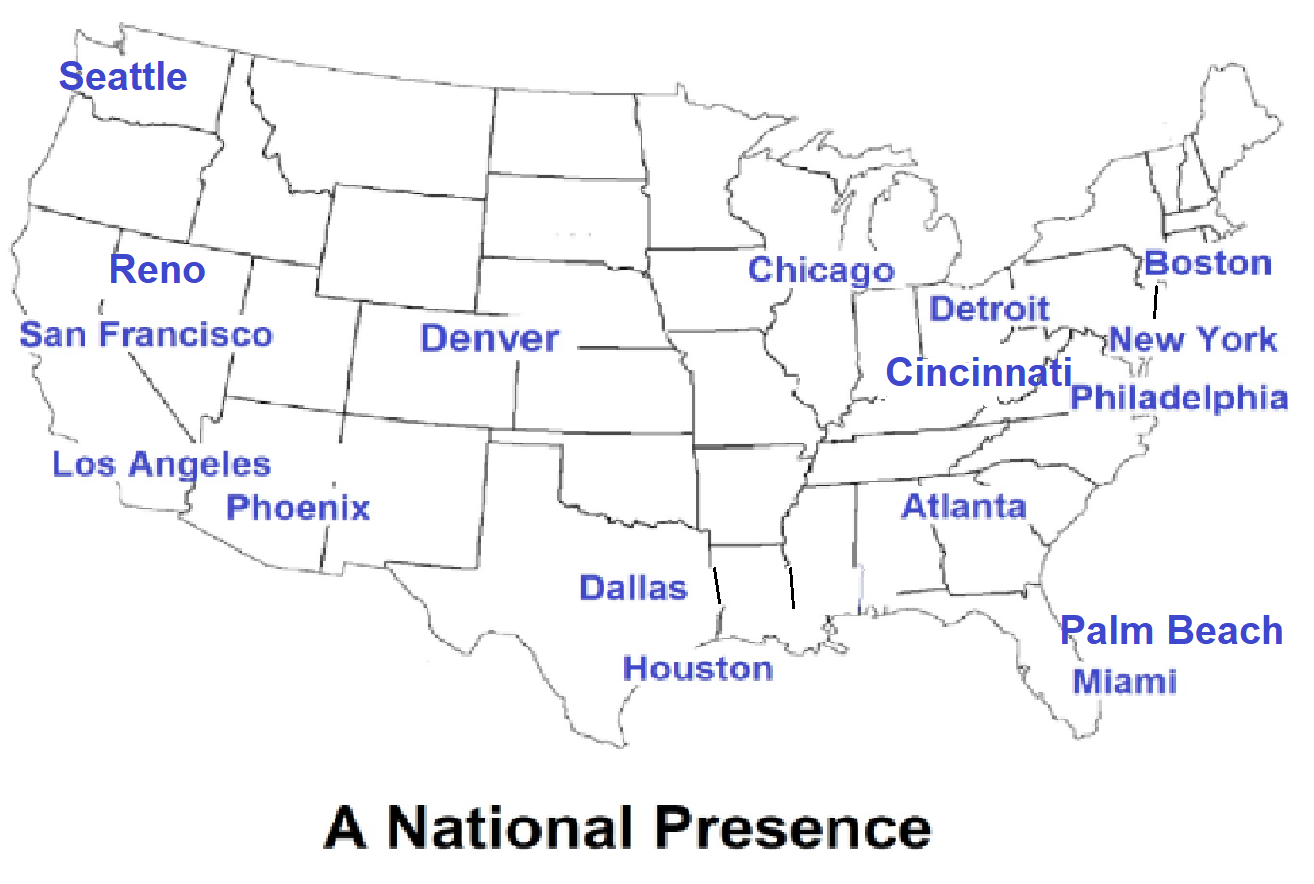

We help to create innovative HR infrastructures that deliver strong sustainable results concentrating on effective organizational structures, prolific communications, and human capital practices that attract and retain high potential talent, all of which are integral to the success of an M&A integration process.