Accounting Firms

Extended

Transaction Advisory Services

Accounting Firms are able to extend involvement

with their clients before and well beyond deal-closing.

Let us help make your clients' M&A deals successful.

Extended Transaction Advisory Services

Historically, accounting firms’ involvements in M&A transactions cease upon deal-closing, with the exception of making a few post-closing adjustments. However, in offering M&A Integration Services in partnership with PMI Advisors, accounting firms are able to extend involvement with their clients in the M&A process for a considerable time period past deal-closing.

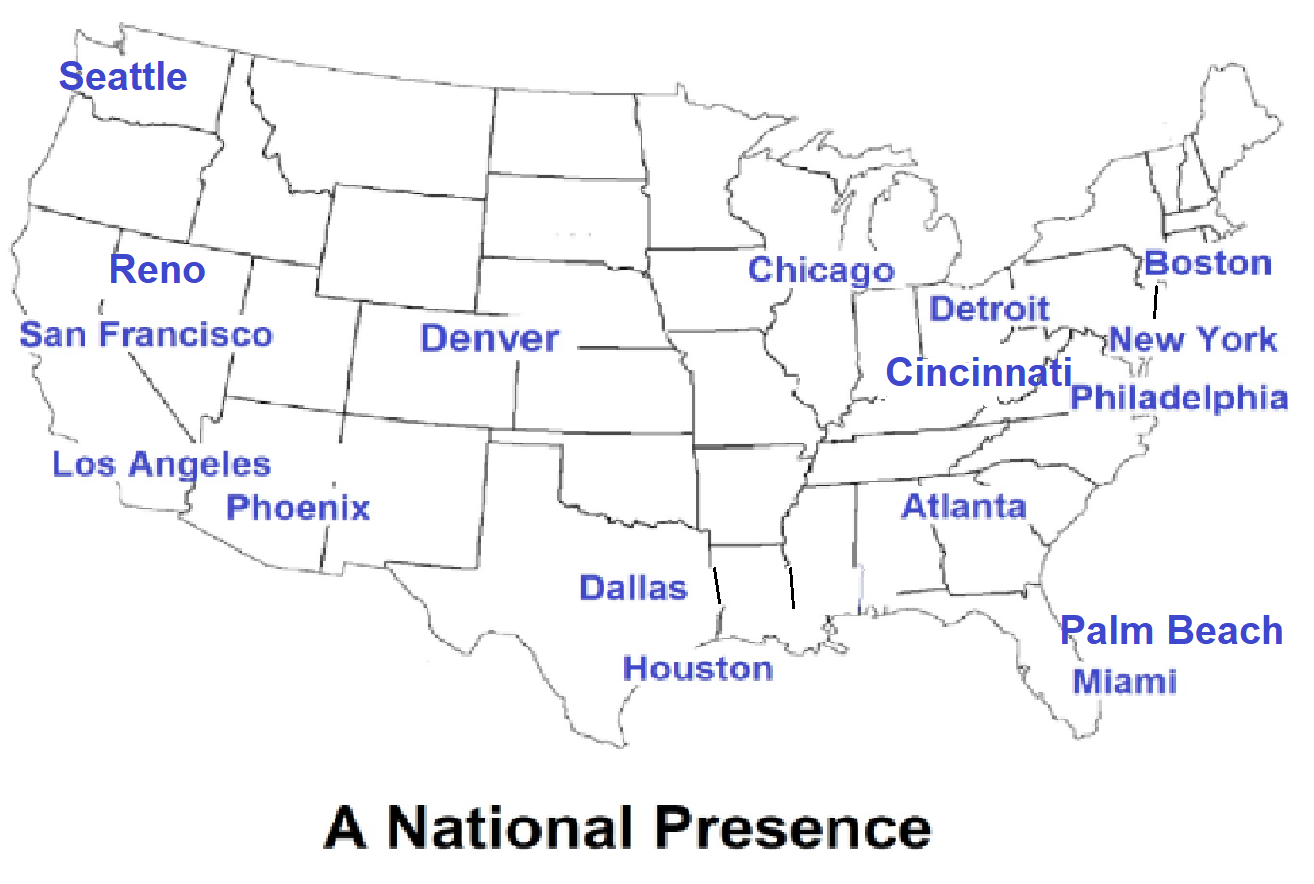

Partnering with PMI Advisors, either as a subcontractor or on a referral basis, provides an extension of the services that accounting firms are able to provide to their clients.

Existing Transaction Advisory Services (TAS)

A large percentage of accounting firms have established M&A Transaction Advisory Services (TAS) groups as practice areas inside their organizations to better serve their clients. In today’s complex business environment, these TAS teams bring together first-hand M&A and corporate finance experience, along with industry knowledge, to help manage risks and enhance shareholder value associated with corporate acquisition transactions.

From developing an M&A strategy to finalizing the deal structure, TAS groups provide a suite of services at each stage of the M&A process to realize efficiencies and value for their clients. The types of services offered typically include:

• CFO Advisory and Support • Financial & Accounting Due Diligence • Valuations

• Quality of Earnings (QoE) • Fixed Asset Planning • Tax Planning and Structuring

• Information Technology Due Diligence • Independent Business Plans Review (IBR) • Segment Reporting Assistance

• Intellectual Property Licensing and Strategy • Transaction Cost Studies

Extend Your TAS Services Beyond Deal Closing With M&A Integration Consulting Services

The services provided via this arrangement could include due diligence reviews of the IT operations, HR systems and procedures, along with coordination of the Legal activities leading up to deal-closing. After deal-closing, our professionals are able to provide hands-on assistance to complete the hundreds of tasks associated with the integration effort. > Learn More

Project:100 Days™ Integration Management Methodology

Our fixed-fee integration consulting methodology, starting at $50k, is typically provided for transactions valued at less than $100 million and is based upon the proven project management approach of identification, assignment, and coordination. Incorporating our Integration Checklist 500™ approach is useful for organizations that have smaller deals, less integration work to do or available in-house resources that just require some additional project management expertise.

M&A Integration Playbooks

Although integration plans are never the same, due to differing risks, issues, and scenarios, using a playbook will enable acquirers to provide a focused and relevant set of actions plans. There is no need to “reinvent the wheel” for each transaction. Instead, take advantage of the prior knowledge that has been assembled into a readily available guide. Also, playbook tools continually evolve as new issues and required actions become apparent in different deals.

Workstream Leadership - Staff Augmentation

Because today's companies are lean, we help our clients handle their hot M&A integration projects without letting their core businesses cool off. We supplement our clients' staffs to get the integration project done with minimal interruptions to the everyday work of the company. Since not all clients want or need full-time dedicated post-merger integration services, our professionals are available to augment their integration teams on an as-needed basis.

. Merger Integration Professionals

. Human Resource Integration

. Information Technology Integration

. Legal Coordination

. Supply Chain & Operations Integration

Carve-Outs & Divestitures

Companies sometimes choose to realign their business models and carve out divisions, subsidiaries or specific business operations, a strategy every bit as important as M&A. The carve-out organization is to exist as an independent and viable company which can then be sold and integrated into another company or exist as an independent stand-alone entity. We can provide support throughout the divestiture process in working with our clients to develop carve-out plans to execute a timely separation of the divested business.