Wealth Advisors

We optimize the business value in preparation for the sale.

Investment Bankers sell the businesses.

You invest the Owner's sales proceeds.

We Help Create, Protect and Optimize Enterprise Value.™

Wealth Advisors' Business-Owner Clients

Statistics show that over 70% of Business Owners' assets are typically locked up in their businesses. Unfortunately, the majority of businesses that go to market don't sell, leaving those Owners without solid options. However, an Owner/CEO who is “ready” with an attractive business greatly increases the odds that the business will find a serious buyer. Recognizing this, we work with Owners/CEOs to approach the exit strategy with the same focus and drive that helped to build their businesses.

Our team of professionals serves as independent experts in preparing businesses for sale. Business Owners/CEOs are able to complement their deep understanding of their businesses with independent, objective experts skilled in functional areas such as operations, finance, technology, human resources, operations, and marketing, to name few.

Our team of professionals serves as independent experts in preparing businesses for sale. Business Owners/CEOs are able to complement their deep understanding of their businesses with independent, objective experts skilled in functional areas such as operations, finance, technology, human resources, operations, and marketing, to name few.

Business Value Optimization

Our Deal Readiness Rating® Methodology gives an Owner/CEO an opportunity to strengthen the overall quality and competency of their company in advance of the sales process. It is a road mapping procedure that utilizes a proprietary assessment and management tool that helps a business maximize its value by:

- Assessing a business’s competency across twenty functional categories, including planning, leadership, sales, marketing, people, operations, finance and legal.

- Identifying and prioritizing a business’s specific risks that are depressing value and obstructing long-term sustainable growth.

- Providing management with visibility into outcomes and return on investment (ROI) for any contemplated initiatives, motivating management to take action to implement specific improvements.

This process enables an Owner/CEO avoid a situation where at the 11th hour they realize that they’re accepting an amount for their business which is less than what they could have received by optimizing operations and reducing the business’s intrinsic risk before going to market.

Preparation Steps

Our Deal Readiness® Methodology of an initial assessment, value creation, and risk mitigation positions the business for sale. Buyers, such as corporations, private equity firms, and family offices will quickly recognize any attempt to hide issues, conceal problems or quickly stage the business, so adequate preparation is essential.

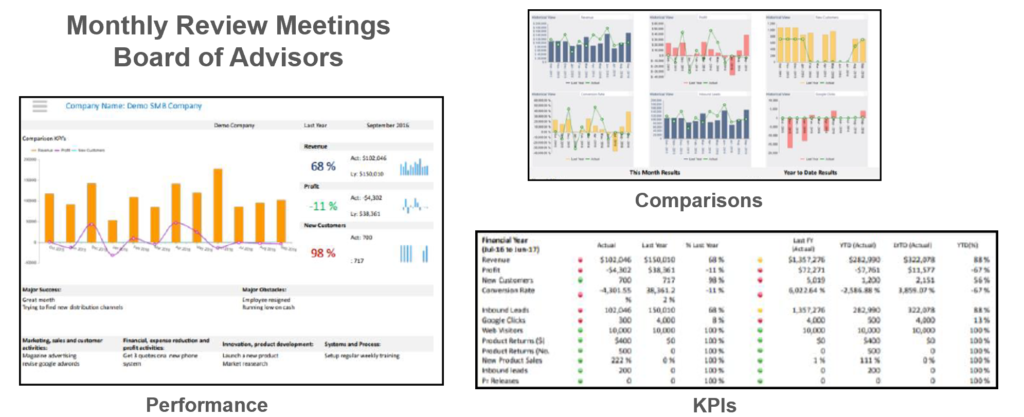

Board of Advisors

A Board of Advisors is composed of accomplished experts offering innovative advice and dynamic perspectives, providing non-binding strategic advice to the management of a company. The composition of the members of the Advisory Board may change periodically, depending upon the needs of the business.

The informal nature of an Advisory Board gives considerable flexibility in structure and management to address issues and growth options.

Client Development - Education

The target market for our Business Sale Preparation services is retiring Baby Boomer Business-Owners with annual revenue in excess of $5 million. These Owners have been heads-down in running their businesses for the past 20 years and are not familiar with the M&A process.

We work alongside Wealth Advisors, Investment Bankers, Accounting Firms, Legal Firms, and others to educate these Owners about the upcoming business sale steps, which can be quite daunting for those who are not familiar with the M&A sales process.

As a complimentary, no-cost client development approach shown in the above graphic, we suggest having a joint consultation meeting with the prospective client. From that meeting, we can then provide a 15-page high-level valuation report based upon the profit multiple ranges for the industry. More importantly, this report provides considerable educational information. The goal is to urge the prospective client to move forward with our Deal Readiness® Assessment, which will be the foundation for the value optimization methodology to follow.

A successful exit requires the navigation of new and highly complex legal and financial territories, while simultaneously running and improving the business for maximization of its value. Our national presence and extensive experience allow us to help clients quickly develop an accurate assessment of and improve key performance issues, including relevant market benchmarks, cash flow drivers, and customer trends.