Trusted Counsel is a corporate and intellectual property law firm dedicated to serving the unique needs of companies, investors and legal departments.

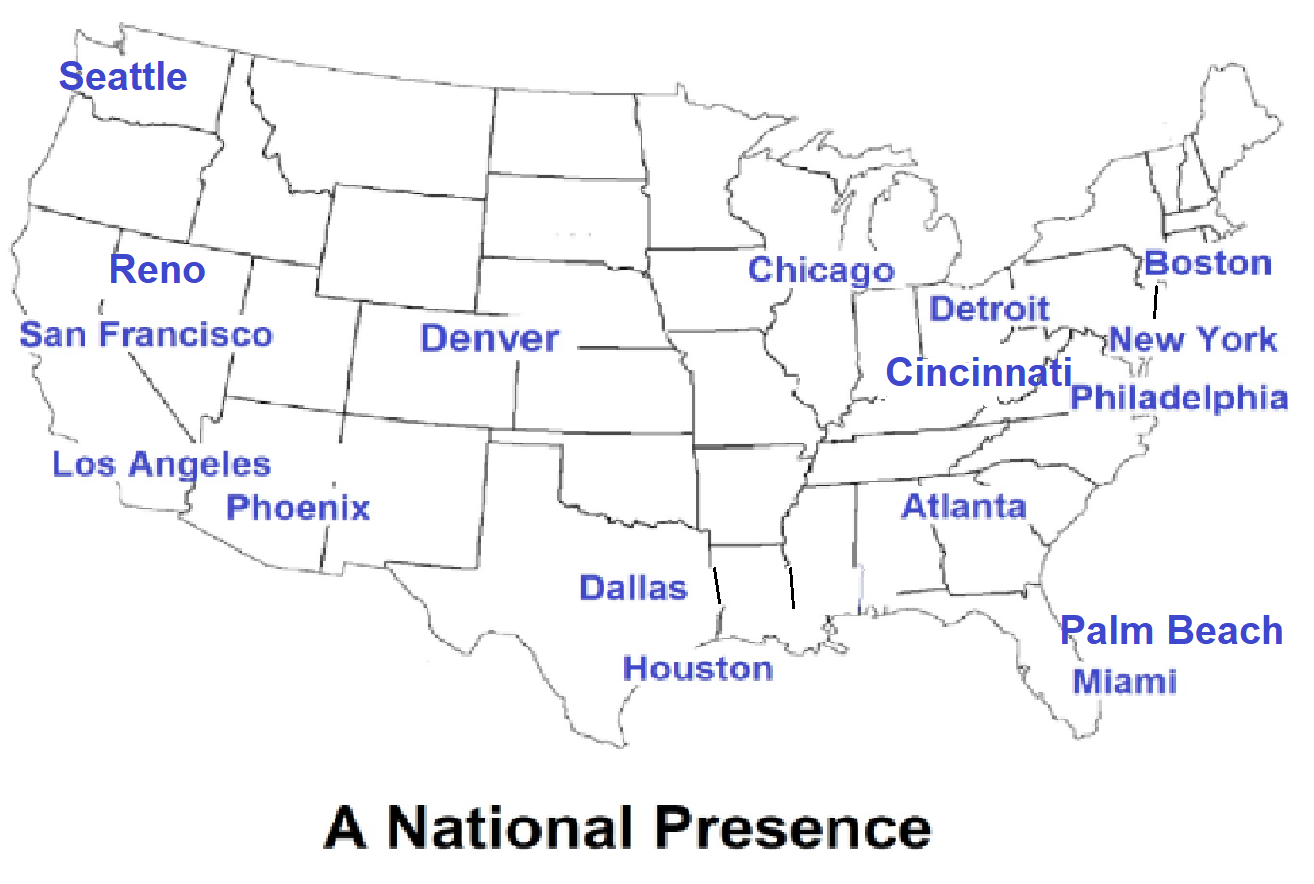

In this episode, broadcast on March 22, 2019, of In-Process™ Podcast: Conversations about Business in the 21st Century, Trusted Counsel’s John Monahon and Valerie Barton (filling in for Evelyn Ashley) speak to Dan Bradbary, Founder and Managing Partner of PMI Advisors. An accomplished entrepreneur, speaker and author, Bradbary has extensive experience with founding and selling various businesses. He founded PMI Advisors in 2017 upon recognizing the under-served needs of mid-market companies regarding post-merger integration. Since its founding, PMI Advisors has expanded practice to other phases of business management and operations, ranging from business continuity planning, sale preparation, business process optimization and divestiture and carve out.

According to Bradbary and PMI Advisors, when preparing a business for sale, the Owner/CEO needs to approach the exit strategy with the same focus and drive that helped to build the business. Hence, an Owner/CEO who is “ready” with an attractive business will greatly improve the probability of a successful business exit.

PMI Advisors recommends the following key steps for a successful exit:

- Hire a consultant who specializes in M&A

Selling a business is a complex process. A consultant will guide business owners through the steps that often include some sort of readiness assessment, plan development, implementation and value optimization. - Perform a business health check-up

One of the first tasks is for the business to undergo a Business Operations/Risk Assessment to identify shortcomings and associated risks. It is critical to de-risk the business as much as possible before opening the company's operations to potential buyers. - Have a transition team

Having a transition team is favorable because they will work alongside you to address all issues involved with selling a business. There will be tax planning needs, legal compliance and succession plans that might need to be put into place. Once you have your transition team in place, schedule an introduction “kick off” meeting. - Structure your advisory board

An advisory board does not have the legal tethering like a board of directors has – it’s more informal and easier to assemble. It’s comprised of qualified subject matter experts that have knowledge of your industry and specialties in areas such as technology, marketing, sales, operations or human resources. They offer suggestions and non-binding recommendations about key elements to make sure your business is attractive to buyers. - If you receive an unsolicited offer - engage with your legal counsel right away

It is very exciting to receive an offer, but Bradbary warns, “you don’t need to rush into signing a letter of intent.” The main area of concern is that once the letter of intent is signed, the business is taken off the market for several months. You need to be prepared to be locked in during that time period.

By taking these key steps you will be well on your way to drastically improve your probability of a successful exit. Be sure to listen to the entire interview below.

- During the course of the podcast CEOs, business owners, and C-level executives will learn:

- The PMI Advisors process when assisting business owners looking to sell

- What is meant by having an emergency operations plan

- The difference between an advisory board versus a board of directors

- Post-sale final thoughts

Don’t miss a single episode of our podcast show. Subscribe to our show “In Process Podcast” on Apple iTunes and on Google Play to receive this episode as well as future episodes to your smartphone.